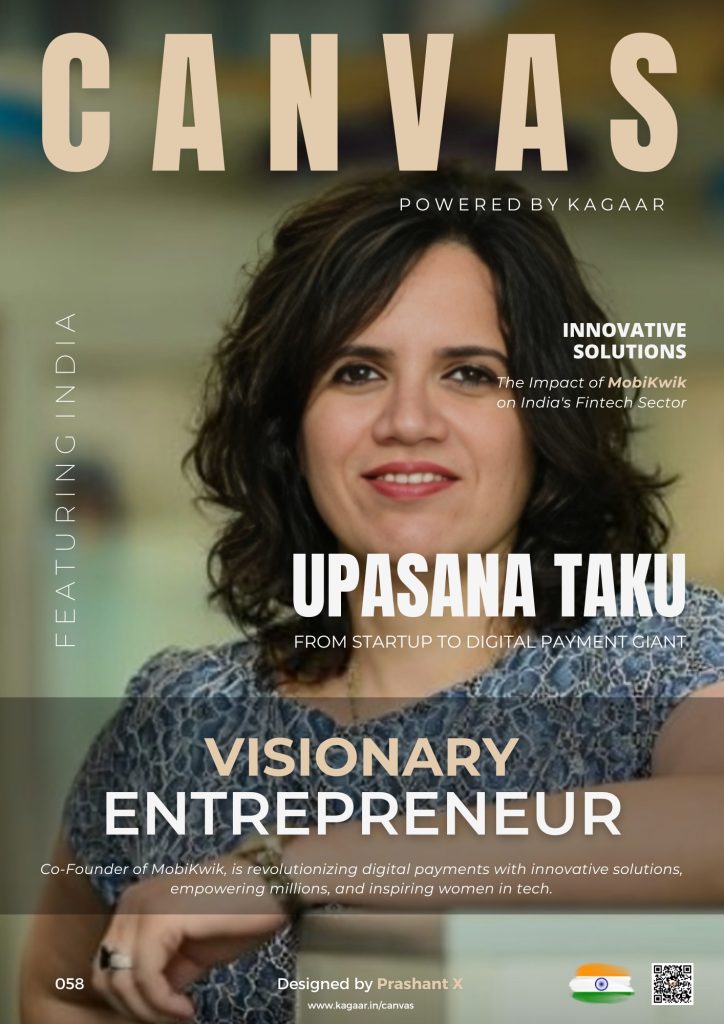

Canvas 058 : Upasana Taku ( MobiKwik ) – Designed by Prashant X – Kagaar

Upasana Taku, Co-Founder of MobiKwik, is a name that resonates with innovation, resilience, and the relentless pursuit of transforming India’s digital payments landscape.

Her journey from a small town in India to becoming one of the most influential women in the fintech industry is nothing short of inspirational.

Upasana’s journey started with a simple yet powerful vision – to simplify payments for millions of Indians.

True innovation lies in the courage to challenge the status quo and the passion to create lasting impact.

Upasana Taku Tweet

With a strong academic background and a career that spanned across continents, Upasana brought a wealth of experience and a fresh perspective to the table when she co-founded MobiKwik in 2009.

Her goal was clear: to create a seamless and secure digital payment ecosystem that could cater to the diverse needs of India’s burgeoning internet population.

Building MobiKwik wasn’t easy. The fintech landscape in India was still nascent, and the challenges were many. But Upasana’s determination and innovative approach helped MobiKwik carve a niche for itself.

Under her leadership, MobiKwik has grown to become one of India’s leading digital payment platforms, offering services ranging from mobile wallets and bill payments to financial services like loans and insurance.

Upasana’s contributions to the fintech industry have not gone unnoticed. In 2018, she received the prestigious honor of being the first female fintech founder felicitated by the President of India.

This recognition was a testament to her pioneering efforts and her role in shaping the future of digital payments in the country.

In 2019, Upasana was featured in Forbes Asia’s 25 Power Businesswomen list, a recognition that highlighted her influence and impact in the business world. Additionally, she was listed in the Kotak Wealth Hurun – richest self-made women in India list, further cementing her status as a leading figure in the industry.

Upasana’s journey is particularly inspiring for women in tech. She has not only broken the glass ceiling but has also become a role model for aspiring female entrepreneurs.

Her success story encourages women to dream big and pursue their ambitions, regardless of the challenges they might face.

Upasana has been vocal about the importance of women in leadership roles and has actively worked towards creating an inclusive work environment at MobiKwik. Her efforts to mentor and support young women in the tech industry have made a significant impact, fostering a culture of diversity and innovation.

Looking ahead, Upasana is focused on driving further innovation at MobiKwik. With the fintech industry evolving rapidly, she is committed to staying ahead of the curve and delivering cutting-edge solutions that cater to the ever-changing needs of consumers.

Her vision for MobiKwik includes expanding its financial services portfolio, leveraging advanced technologies like artificial intelligence and blockchain, and continuing to enhance the user experience.

Upasana believes that the future of fintech lies in creating holistic financial ecosystems that offer convenience, security, and value to users.

Despite her professional achievements, Upasana remains grounded and approachable. She often reflects on her journey and the lessons learned along the way.

For her, the true measure of success lies not in accolades but in the positive impact MobiKwik has had on people’s lives.

In her own words, “The journey of building MobiKwik has been filled with highs and lows, but it’s the passion for making a difference that keeps me going.

Every time a user tells us how MobiKwik has made their life easier, it reaffirms our mission and motivates us to do even better.”

Upasana Taku’s story is a powerful reminder that with vision, determination, and resilience, one can overcome any obstacle and achieve greatness.

As the co-founder of MobiKwik, she has revolutionized digital payments in India and continues to inspire countless individuals, especially women, to pursue their dreams and make a meaningful impact in their chosen fields.

In celebrating her journey and achievements, we also celebrate the spirit of innovation and the unwavering commitment to creating a better, more inclusive future for all.

Upasana Taku is not just a leader in fintech; she is a beacon of inspiration for anyone looking to make a difference in the world.

The Impact of MobiKwik on India's Fintech Sector

India’s fintech sector has witnessed exponential growth over the past decade, driven by technological advancements, increased internet penetration, and a burgeoning digital-savvy population.

At the forefront of this revolution stands MobiKwik, a pioneering digital payments platform co-founded by Upasana Taku. MobiKwik’s journey from a nascent startup to a fintech giant has significantly shaped the landscape of digital payments in India.

MobiKwik’s inception in 2009 came at a time when digital payments were still in their infancy in India. The company aimed to simplify transactions for millions of users by providing a secure, user-friendly platform for mobile recharges and bill payments.

This vision quickly expanded to encompass a broader range of financial services, including digital wallets, peer-to-peer payments, and e-commerce transactions.

One of the key impacts of MobiKwik has been its role in democratizing digital payments. By offering a seamless and intuitive user experience, MobiKwik made it easier for people from diverse backgrounds to adopt digital payments, thus accelerating the shift away from cash-based transactions.

This inclusivity has been instrumental in bringing financial services to the unbanked and underbanked segments of the population.

Financial inclusion has been a cornerstone of MobiKwik’s mission. The platform’s easy-to-use interface and widespread availability have empowered millions of Indians to participate in the digital economy.

MobiKwik has particularly made a difference in rural and semi-urban areas, where traditional banking infrastructure is often lacking.

MobiKwik’s partnership with various merchants and service providers has further broadened its reach, allowing users to make payments for a wide array of services, from utility bills to shopping.

This extensive network has not only facilitated convenience for users but has also enabled small businesses to embrace digital transactions, thereby fostering economic growth at the grassroots level.

MobiKwik’s success can be attributed to its relentless focus on innovation. The platform has continually evolved, incorporating the latest technologies to enhance user experience and security. From biometric authentication to AI-driven fraud detection, MobiKwik has set new benchmarks in the industry.

One of the notable innovations introduced by MobiKwik is the “Boost” feature, which leverages data analytics to offer instant credit to users based on their transaction history.

This micro-lending service has provided users with quick access to funds, addressing short-term financial needs and promoting responsible borrowing.

Additionally, MobiKwik’s integration of the Unified Payments Interface (UPI) has been a game-changer, enabling seamless interoperability between different banks and payment platforms. This has not only simplified transactions but has also driven the adoption of digital payments across the country.

In the fintech sector, trust and security are paramount. MobiKwik has prioritized these aspects by implementing robust security measures and transparent policies.

The platform’s commitment to safeguarding user data and ensuring secure transactions has earned it the trust of millions of users.

MobiKwik’s proactive approach to compliance with regulatory standards has also been commendable. By adhering to the guidelines set by the Reserve Bank of India (RBI) and other regulatory bodies, MobiKwik has demonstrated its commitment to maintaining the highest standards of integrity and reliability.

MobiKwik’s impact extends beyond its own platform. As a pioneer in the fintech space, MobiKwik has played a crucial role in shaping the broader ecosystem. Its success has inspired a wave of fintech startups, contributing to the dynamic and competitive landscape that characterizes India’s fintech sector today.

Furthermore, MobiKwik’s strategic partnerships with banks, financial institutions, and other fintech companies have fostered collaboration and innovation.

These alliances have facilitated the development of comprehensive financial solutions that cater to diverse customer needs, driving the overall growth and maturity of the sector.

As MobiKwik continues to innovate and expand its services, its future looks promising. The platform’s vision of creating a cashless economy aligns with the Indian government’s digital initiatives, making it a key player in the country’s financial transformation.

Looking ahead, MobiKwik aims to deepen its engagement with users by introducing new financial products and services. From insurance to investments, MobiKwik is poised to become a holistic financial platform that caters to the evolving needs of its users.

MobiKwik’s journey from a startup to a fintech leader is a testament to the power of innovation, vision, and resilience.

Its impact on India’s fintech sector is profound, driving financial inclusion, democratizing digital payments, and setting new standards in technology and security.

Under the leadership of Upasana Taku and her team, MobiKwik continues to shape the future of digital finance in India.

As the platform grows and evolves, it remains committed to its mission of making financial services accessible, convenient, and secure for all.

Thanks for reading this post, kagaar!

Congratulations to Upasana Taku & MobiKwik team! 🧡